Chicago Option Pricing Model v.1.0

Advertisement

Description

A graphing calculator implementation of the Black-Scholes Option Pricing Model, with extensions for both American Style Options and Extreme Value Theory.

- Developer:chipricingmodel.sourceforge.net

- Downloads:315

- Size:506 Kb

- Price: Free

To free download a trial version of Chicago Option Pricing Model, click here

To visit developer homepage of Chicago Option Pricing Model, click here

Advertisement

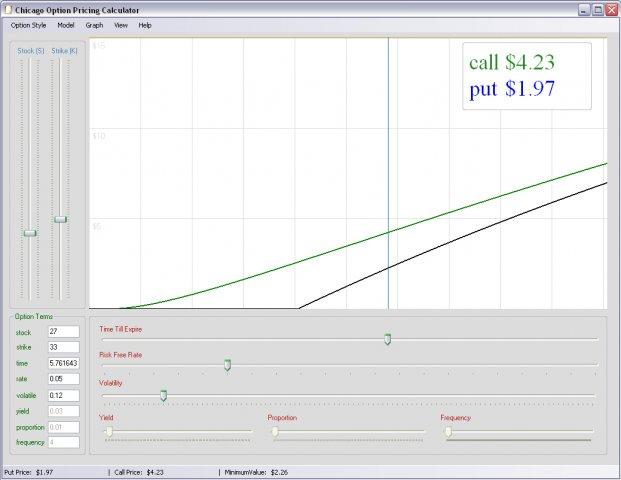

Screen Shot

Click on a thumbnail for the larger image.

System Requirements

Chicago Option Pricing Model requires Mac, Windows, Linux.

Chicago Option Pricing Model v.1.0 Copyright

Shareware Junction periodically updates pricing and software information of Chicago Option Pricing Model v.1.0 full version from the publisher using pad file and submit from users. Software piracy is theft, Using crack, password, serial numbers, registration codes, key generators, cd key, hacks is illegal and prevent future development of Chicago Option Pricing Model v.1.0 Edition. Download links are directly from our publisher sites. Links Chicago Option Pricing Model v.1.0 from Bittorrent, mediafire.com, uploadfiles.com, hotfiles.com rapidshare.com, megaupload.com, netload.in, storage.to, depositfiles.com and other files hosting are not allowed. The download file is obtained directly from the publisher, not from any Peer to Peer file sharing applications such as Shareaza, Limewire, Kazaa, Imesh, eDonkey, eMule, Ares, BearShare, Overnet, Morpheus, BitTorrent Azureus and WinMX.

Review This Software

More Chicago Option Pricing Model Software

Advertisement

Option Pricing Calculator

This free option pricing calculator can be used to calculate: Call Price, Put Price, Gamma, Delta, Theta, Vega, Implied Volatility. Calculator can use three option pricing models to caculate prices: Black-Scholes Option price, Binomial American option

Option Calculator v.2.1.0.0

Application allows user to determine payout characteristics of any arbitrary option spread and is based on Black-Scholes theoretical option pricing model.

Option Calculator P v.2.0.0.0

Application allows user to determine payout characteristics of any arbitrary option spread and is based on Black-Scholes theoretical option pricing model.

OptionEdge v.2 1

OptionEdge is a stock option trading application for use with Microsoft Excel. The program utilizes the Black-Scholes option pricing model to simulate and analyze various stock option trading strategies.

Option Trading Workbook

Option pricing spreadsheet that calculates the theoretical price and all of the Option Greeks for European Call and Put options. The spreadsheet also allows the user to enter up to 10 option legs for option strategy combination pricing. The calculations

Real Option Valuation

The Real Option Valuation model encompasses a suite of option pricing tools to quantify the embedded strategic value for a range of financial analysis and investment scenarios. Traditional discounted cash flow investment analysis will only accept an

Black Scholes Calculator v.1.0.0.0

This application can be used to calculate option prices and Greeks of European Call and European Put options. It uses the Black Scholes Merton pricing Model of 1973. Make sure you are familiar with the assumptions of the model, e.

Calc 12c Platinum v.1.3.0.0

The Calc 12c Platinum financial calculator is a software replica of the original HP 12c Platinum.

FinOptions XL v.3.0.2

Excel Financial Analytics Add-in valuing option price, risk sensitivities and implied volatility on a broad range of financial instruments including options, futures, exotic, bond options and interest rate assets directly within your spreadsheet.

FOCalculator v.1.0.0.0

Application is targeted to derive the pricing of Stock's Future & Option contracts. Application currently has two calculators - 1) Stock Future / Fair Value Calculator 2) Options Calculator Stock Future / Fair Value Calculator --> Fair value is the

Visual Stock Options

Visual Stock Options Analyzer is a powerful analysis tool for development, testing, and application of stock and options strategies. Its easy-to-use interface allows you to test new strategies, manage a growing portfolio, and explore "what-if" scenarios